Last updated on June 7th, 2023

Invoices play a crucial role in the financial operations of businesses. They serve as essential documentation for requesting payment from clients and keeping track of income.

However, if this is the first time you’re sending an invoice, knowing what to include on an invoice can be a bit daunting. In this guide, we’ll walk you through the key elements to include on an invoice to ensure accuracy, professionalism, and prompt payment.

The Basic Elements

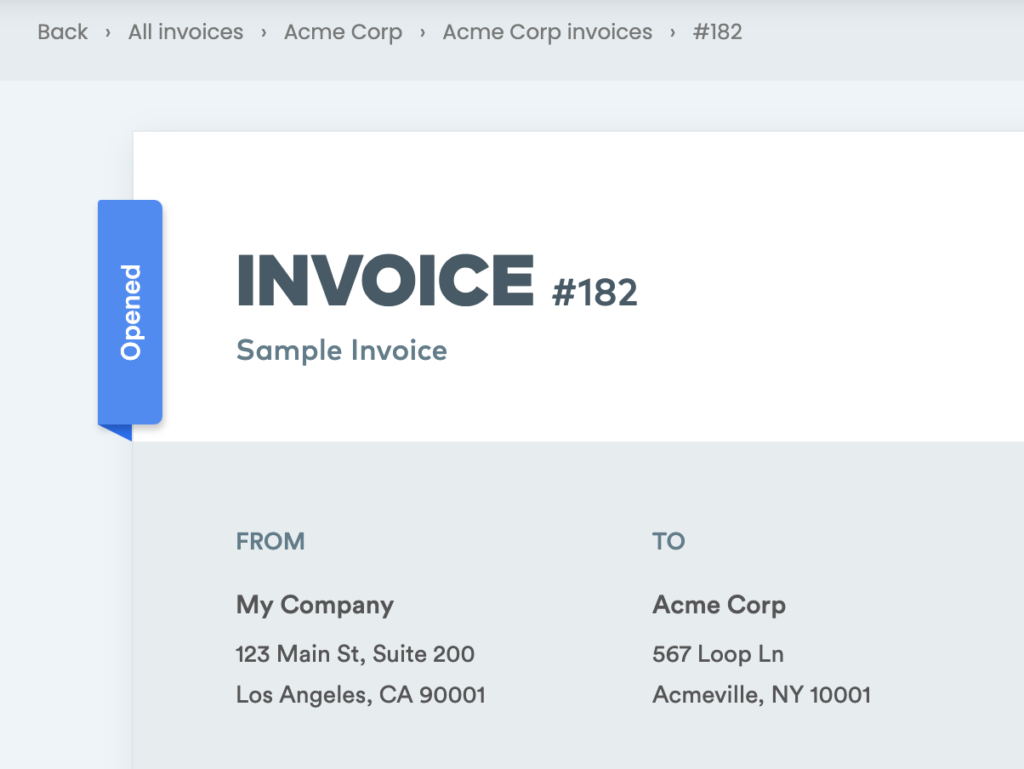

- Include Your Business Information:

To start, make sure to display your business name, logo, and contact information prominently at the top of the invoice. This information helps identify your business and ensures that clients can easily reach out to you with any inquiries or concerns. Additionally, assigning a unique invoice number to each invoice allows for better tracking and organization of your financial records. - Client Information:

Alongside your business details, it’s crucial to include the client’s information on the invoice. This includes their name, address, and contact details. Double-check the accuracy of the client’s information to avoid any payment delays or communication issues. - Invoice Date and Due Date:

Clearly state the invoice date to indicate when the invoice was issued. This helps both you and your clients keep track of the timeline. Additionally, specify a due date for payment, which informs your clients about the payment deadline. Setting a clear due date helps ensure timely payments and avoids any confusion. - Itemized List of Services or Products:

Provide a detailed breakdown of the services or products you provided to the client. Include the quantity, description, unit price, and the total amount for each item. By offering an itemized list, you provide transparency and clarity regarding the services or products rendered. This also helps clients understand the value they are receiving and reduces the chances of disputes or misunderstandings. - Terms and Conditions:

It’s essential to outline your payment terms and conditions on the invoice. Include information such as accepted payment methods, late payment penalties, or any applicable discounts. Clearly communicate any specific terms or policies related to payments. This ensures that both you and your clients are on the same page regarding expectations and helps avoid any potential conflicts. - Tax Information:

If applicable, include the necessary tax information on your invoice. This may include sales tax, value-added tax (VAT), or other applicable taxes. Clearly state the tax rates and calculations to ensure transparency. Additionally, make sure to comply with tax regulations and include any necessary tax identification numbers. - Payment Instructions:

To facilitate smooth and timely payment processing, clearly explain the payment methods available to your clients. This may include options such as bank transfer, credit card payments, or online payment platforms. Provide the necessary details, such as account numbers or payment links, to make it convenient for clients to submit their payments.

By including these essential elements on your invoices, you can ensure clarity, professionalism, and prompt payment from your clients. In the second part of this guide, we’ll explore additional elements that can enhance your invoices and strengthen your business relationships.

Getting Fancy

The basic invoice is nothing more than a document and it can be delivered to your clients in different ways. A popular format for an invoice is a PDF, which is important because it prints well and can also act as a digital document of record for both the recipient and the sender.

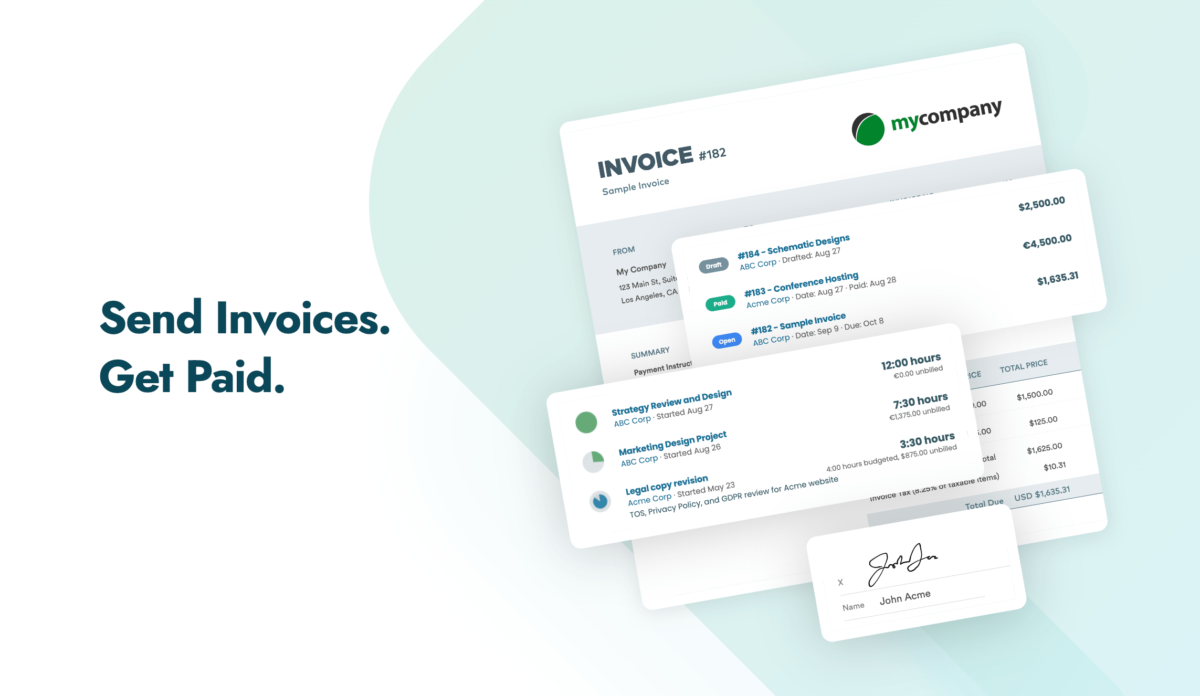

However, if you’re finding yourself in a situation where you will likely be invoicing multiple clients or sending multiple invoices to the same client over a period of time, you may want to look for an online invoicing solution. This is will come in handy because managing a business is more than just about sending invoices — you will need to make sure you can manage them as well!

If you’d like to get going with an invoicing system that is customizable and intuitive in just a few minutes, take a look at Clientary, which was designed for small business invoicing.

Remember, creating well-crafted invoices is not only about requesting payment; it’s an opportunity to showcase your professionalism and build strong relationships with your clients.