Last updated on January 14th, 2023

While we typically associate the end of the year with holidays and new year’s resolutions, it’s also an extremely important time for businesses. There’s a lot that needs to happen at the end of one year heading into the beginning of another that is above and beyond the typical month-end or quarter-end routine. There is enough work here that the IRS gives U.S. businesses until the middle of March to get their documents in order!

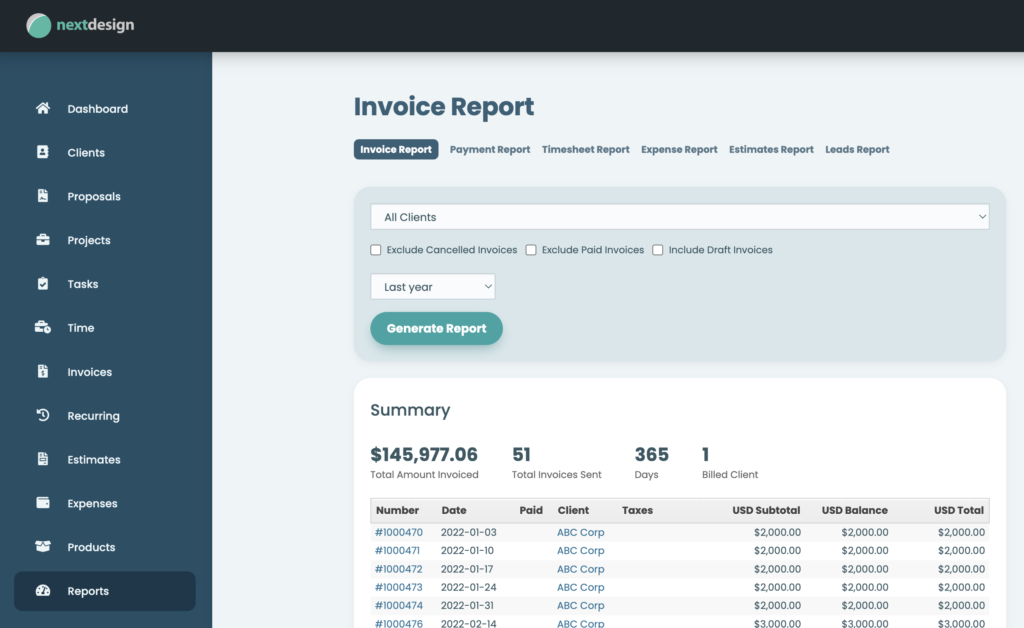

As a professional services business, it’s important to keep track of your financial performance and understand how your business is doing. One way to do this is by reviewing year-end reports, which provide a snapshot of your business results over the past year. A good invoicing system can be a valuable tool for generating these reports and gaining insights into your financial performance, which can feed into your accounting system. Here are a few reasons why it’s important to have an invoicing system in place, above and beyond a standard accounting package, to review year-end reports:

Get an overview of business results

An invoicing system can help you track your revenue, expenses, and profit over the course of the year, which can give you a clear picture of your overall business performance. This can help you identify areas of strength and areas for improvement, and make informed decisions about your business going forward. In a time of year where we’re making personal resolutions, it’s also an opportune moment to take a retrospective look at your business and make some decisions for your future. Your invoicing volume, payment timelines, tracked hours, and expense reports can all help inform your decisions.

Prepare for tax season

Reviewing year-end reports can also be helpful for preparing for tax season. By having a clear understanding of your financial performance, you can better understand your tax liability and ensure that you have all of the necessary documentation in order. An invoicing system can help you generate the reports and documents you need for tax preparation. You’ll want to work with a system that imports easily into your accounting system or choice. Or alternatively, a system that produces data that you can hand to your accountant is desirable.

Help clients understand their expenses

If you work with clients who are responsible for figuring out their own tax picture (and that’s probably any of them that are businesses), an invoicing system can help you provide them with clear and detailed reports of their expenses over the course of the year. This can be particularly helpful for clients who need these numbers to report 1099s to the IRS, or are simply looking to understand their spending with businesses with whom they have a long term relationship. When a client request for this information comes in and you don’t have a system prepared to help you produce the necessary reports, you risk looking unprofessional and unprepared, putting you in a position where you will have to scramble to provide what’s needed.

Forecast future performance

By reviewing year-end reports, you can also get a sense of your business’s future performance and make informed predictions about what to expect in the coming year. An invoicing system can help you generate reports and analyze data to give you a better understanding of your business’s strengths and weaknesses, and help you plan for the future. Sometimes, this isn’t as important if your business is smaller, but if there are outside interests, such as investors or partners, this becomes a matter of necessity. There are a number of different reports that are popular at year-end, including profit and loss statements, balance sheets, and cash flow statements. An invoicing system can help you generate these reports quickly and easily, giving you a clear picture of your financial performance and helping you make informed decisions about your business.

Understand your team

In addition to understanding financial performance, year-end reports can also be helpful for understanding staff performance. By tracking the time and resources that your team members have dedicated to different projects and clients, you can get a sense of which team members are most productive and efficient, and identify areas for improvement. An invoicing system can help you track this information and generate reports that allow you to analyze your team’s performance and identify areas for improvement. By understanding your team’s strengths and weaknesses, you can better allocate resources and set goals to help your team achieve success in the coming year.

Don’t be caught scrambling for numbers and fumbling around with a vague picture of your business. Make sure you have tooling for your professional services business so you’re always in a position of high visibility of your business performance. Sometimes it’s important for you, but many times it’s simply a necessity for your clients and you don’t want to be caught unprepared. Whether you’re an architect, lawyer, consultant, marketer, artist, writer, or engineer, if your firm engages with clients, you will often find yourself in a position where having this data is critical.

Does your currently tooling help you solve these problems? If not, have a look at Clientary, which is designed specifically to solve this problem and more for freelancers, agencies, and businesses of all sizes.